It's A Money Thing

Who said financial education has to be all serious and boring? Join our main character Jen on her journey to understand everything there is to know about money. It's A Money Thing is also used by our Synergy Emerging Leaders group in schools and community groups as part of our financial literacy presentations.

GOLDEN YEARS

Retirement & Saving

Planning for retirement is a crucial aspect of financial management, and choosing the right retirement savings account can significantly impact your financial future.

Retirement & Taxes

Planning for retirement involves not only accumulating savings but also understanding the tax implications of various investment vehicles.

Retirement & Saving

Planning for retirement is a crucial aspect of financial management, and choosing the right retirement savings account can significantly impact your financial future.

Retirement & Taxes

Planning for retirement involves not only accumulating savings but also understanding the tax implications of various investment vehicles.

BUYING GOODS AND SERVICES

Are Cheques Obsolete?

Cheques hold an odd place in our personal finances. In many ways, cheques seem like relics from a previous era.

Tips For Every Budgeting System

Budgets are like the New Year’s resolutions of personal finance. We all know we should have one and we all know it’s a fairly simple thing to follow.

Budgeting with 50/30/20

Budgeting is a skill that helps you make smart decisions with your money.

Use Psychology to Build a Budget

When you start looking for financial advice (or any kind of advice, for that matter), experts will share their take on what’s “good” and what’s “bad”.

Breaking Up with Name Brands

Picture this scenario: you’re steering your shopping cart through the sliding doors of the supermarket, shopping list in hand.

3 Hidden Expenses of Pet Ownership

Canadian pet owners spent an estimated $8.23 billion on pets in 2017, according to Statistics Canada.

Are Cheques Obsolete?

Cheques hold an odd place in our personal finances. In many ways, cheques seem like relics from a previous era.

Tips For Every Budgeting System

Budgets are like the New Year’s resolutions of personal finance. We all know we should have one and we all know it’s a fairly simple thing to follow.

Budgeting with 50/30/20

Budgeting is a skill that helps you make smart decisions with your money.

Use Psychology to Build a Budget

When you start looking for financial advice (or any kind of advice, for that matter), experts will share their take on what’s “good” and what’s “bad”.

Breaking Up with Name Brands

Picture this scenario: you’re steering your shopping cart through the sliding doors of the supermarket, shopping list in hand.

3 Hidden Expenses of Pet Ownership

Canadian pet owners spent an estimated $8.23 billion on pets in 2017, according to Statistics Canada.

EARNING AN INCOME

The Challenges of Choosing a Career

“When I grow up, I want to be a ___________.” Depending on who you are, filling in the blank above can be an exciting, troubling or outright confusing task.

7 Tips for Tracking Down Your Dream Career

Choosing a career is tough. Whether you’re a new grad or considering a career change, it’s easy to feel overwhelmed when selecting your next gig.

Scholarship Application Time-Savers

Successful scholarship applications take considerable time and effort. Although there’s no shortcut to a quality application, there are steps you can take to make your efforts as rewarding as possible.

Three Job Interview Mindsets

It’s the night before the interview. Your outfit is all laid out, your resumé is hot off the press and you’ve Google-Mapped your route. You’ve done your company research and practised answering tough questions.

Understanding and Directing Your Withholdings

You just got your paycheque. Your eyes scan down the list of deductions and settle on the most important part—your take-home pay.

Where You Seek Financial Advice Says a Lot About You

How did you decide where to open your first bank account? Where did you learn to budget or pay bills? If you have a money question now, what do you do?

What’s Your Time Worth?

It’s hard to ignore the appeal of making real money online—after all, we live in a world where bloggers land book and movie deals...

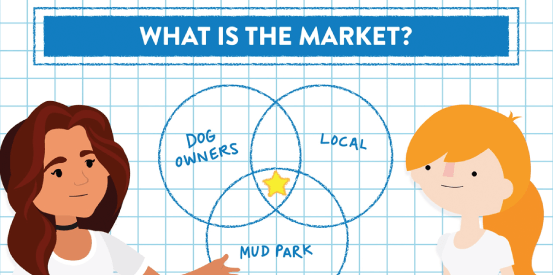

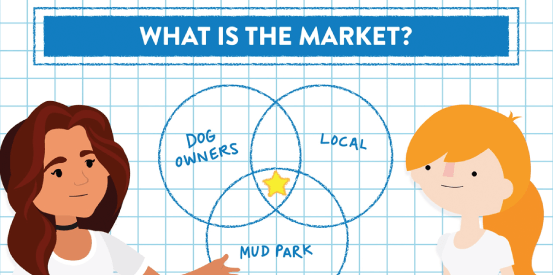

When’s the best time to write a business plan?

Writing a business plan is an essential part of building a successful business. At its core, a business plan is a road map for your project.

Navigating Income Loss

Losing your job is stressful. Even with an emergency fund in place, it doesn’t take very long to feel the financial impact of a sudden loss of income.

Working from Home

The number of people working remotely is on the rise—and so are new trends in work-from-home fashion.

The Challenges of Choosing a Career

“When I grow up, I want to be a ___________.” Depending on who you are, filling in the blank above can be an exciting, troubling or outright confusing task.

7 Tips for Tracking Down Your Dream Career

Choosing a career is tough. Whether you’re a new grad or considering a career change, it’s easy to feel overwhelmed when selecting your next gig.

Scholarship Application Time-Savers

Successful scholarship applications take considerable time and effort. Although there’s no shortcut to a quality application, there are steps you can take to make your efforts as rewarding as possible.

Three Job Interview Mindsets

It’s the night before the interview. Your outfit is all laid out, your resumé is hot off the press and you’ve Google-Mapped your route. You’ve done your company research and practised answering tough questions.

Understanding and Directing Your Withholdings

You just got your paycheque. Your eyes scan down the list of deductions and settle on the most important part—your take-home pay.

Where You Seek Financial Advice Says a Lot About You

How did you decide where to open your first bank account? Where did you learn to budget or pay bills? If you have a money question now, what do you do?

What’s Your Time Worth?

It’s hard to ignore the appeal of making real money online—after all, we live in a world where bloggers land book and movie deals...

When’s the best time to write a business plan?

Writing a business plan is an essential part of building a successful business. At its core, a business plan is a road map for your project.

Navigating Income Loss

Losing your job is stressful. Even with an emergency fund in place, it doesn’t take very long to feel the financial impact of a sudden loss of income.

Working from Home

The number of people working remotely is on the rise—and so are new trends in work-from-home fashion.

SAVING

How to Counter the Effects of Inflation

When most people think of inflation, their response is usually similar to when they see a vintage advertisement: reminiscing about the cheaper prices of the past...

How to Automatically Start Saving Money

Like going to the gym or eating a healthy diet, saving money is one of those concepts that’s simple to grasp but weirdly challenging to put into practice.

Be Prepared, Because Life Happens

An emergency fund is an essential part of your personal finances. Its importance is stressed in almost every personal finance book and budgeting blog...

Avoid the Lifestyle Creep

Have you ever caught yourself daydreaming about all of the amazing lifestyle changes that await you just beyond your next pay raise?

Responding to Financial Emergencies

The COVID-19 pandemic is a sobering reminder that financial challenges come in all shapes and sizes.

Saving With New Skills

Learning a new skill has many potential benefits. It can entertain you; it can save you money, it can boost your self-confidence, and it can unlock new opportunities at school and at work.

How to Counter the Effects of Inflation

When most people think of inflation, their response is usually similar to when they see a vintage advertisement: reminiscing about the cheaper prices of the past...

How to Automatically Start Saving Money

Like going to the gym or eating a healthy diet, saving money is one of those concepts that’s simple to grasp but weirdly challenging to put into practice.

Be Prepared, Because Life Happens

An emergency fund is an essential part of your personal finances. Its importance is stressed in almost every personal finance book and budgeting blog...

Avoid the Lifestyle Creep

Have you ever caught yourself daydreaming about all of the amazing lifestyle changes that await you just beyond your next pay raise?

Responding to Financial Emergencies

The COVID-19 pandemic is a sobering reminder that financial challenges come in all shapes and sizes.

Saving With New Skills

Learning a new skill has many potential benefits. It can entertain you; it can save you money, it can boost your self-confidence, and it can unlock new opportunities at school and at work.

USING CREDIT

Credit Score Breakdown

You’ve likely heard about credit scores before (thanks to all those commercials with terrible jingles), but what do you actually know about them?

Boost Your Credit Score: 4 Myths Debunked

Credit scores are an area of personal finance that seem a lot more mysterious than they actually are.

Credit Score Breakdown

You’ve likely heard about credit scores before (thanks to all those commercials with terrible jingles), but what do you actually know about them?

Boost Your Credit Score: 4 Myths Debunked

Credit scores are an area of personal finance that seem a lot more mysterious than they actually are.

BORROWING

Finding The Loan That’s Right For You

Loans help finance some of our biggest goals in life. They can provide access to possibilities that we can’t afford upfront...

5 Ways to Lower the Cost of Tuition Before Considering a Student Loan

If you’re considering financing your university education with the help of a student loan, the smartest thing you can do for yourself is to only borrow what you truly need.

To Lease or To Finance: That is the Question!

When it comes to buying a new car, you have three options: purchasing it with cash, financing it or leasing it.

Beware of Fast Cash

Like local car dealerships and personal injury law firms, short-term and payday lenders tend to have the most annoying commercials on TV.

Buying vs. Renting a Home: Are You Getting the Right Advice?

The average person moves residences about 11 times in their lifetime.

4 Questions to Ask Yourself Before Signing a Mortgage

Asking the right questions is an important part of every financial decision you make, and home ownership is no exception.

The Dos and Don’ts of Debt Repayment

Consumer debt is an extremely contradictory part of our personal finances: it’s at once common and incredibly personal.

Finding The Loan That’s Right For You

Loans help finance some of our biggest goals in life. They can provide access to possibilities that we can’t afford upfront...

5 Ways to Lower the Cost of Tuition Before Considering a Student Loan

If you’re considering financing your university education with the help of a student loan, the smartest thing you can do for yourself is to only borrow what you truly need.

To Lease or To Finance: That is the Question!

When it comes to buying a new car, you have three options: purchasing it with cash, financing it or leasing it.

Beware of Fast Cash

Like local car dealerships and personal injury law firms, short-term and payday lenders tend to have the most annoying commercials on TV.

Buying vs. Renting a Home: Are You Getting the Right Advice?

The average person moves residences about 11 times in their lifetime.

4 Questions to Ask Yourself Before Signing a Mortgage

Asking the right questions is an important part of every financial decision you make, and home ownership is no exception.

The Dos and Don’ts of Debt Repayment

Consumer debt is an extremely contradictory part of our personal finances: it’s at once common and incredibly personal.

PROTECTING AND INSURING

5 Identity Theft Jackpots

Identity theft is nothing new, and yet it still manages to cost its victims billions of dollars (yes, that’s billions with a “b”) globally each year...

Why We Get Scammed

If you use a cellphone or have an email account, you’ve almost certainly been exposed to an attempt at mass marketing fraud.

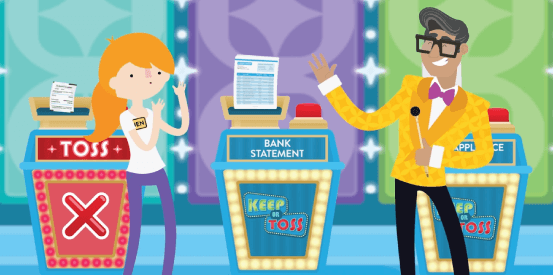

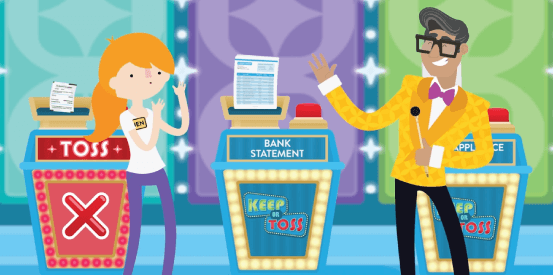

Keep or Toss?

Every year, it’s nice to do a bit of “financial spring cleaning” and declutter the various hiding places where miscellaneous scraps of paper tend to accumulate.

5 Identity Theft Jackpots

Identity theft is nothing new, and yet it still manages to cost its victims billions of dollars (yes, that’s billions with a “b”) globally each year...

Why We Get Scammed

If you use a cellphone or have an email account, you’ve almost certainly been exposed to an attempt at mass marketing fraud.

Keep or Toss?

Every year, it’s nice to do a bit of “financial spring cleaning” and declutter the various hiding places where miscellaneous scraps of paper tend to accumulate.

CREDIT UNION ADVANTAGE

Choosing Your Financial Institution

The very first financial decision you ever made is also one of the most important choices—where to keep your money.

5 Totally Free Things You Can Do to Support Your Local Economy

Supporting your local community is a positive thing—it builds relationships, it strengthens the local economy, and it makes your neighbourhood a happier and healthier place to work and play.

What does it mean to be a credit union member?

Even though there are over 250 credit unions in Canada, many misconceptions about their structure and their services still exist.

Why Is It Called A Credit Union?

While bank and banking are universally understood and accepted terms, the term credit union is still largely misunderstood and unknown to many.

Choosing Your Financial Institution

The very first financial decision you ever made is also one of the most important choices—where to keep your money.

5 Totally Free Things You Can Do to Support Your Local Economy

Supporting your local community is a positive thing—it builds relationships, it strengthens the local economy, and it makes your neighbourhood a happier and healthier place to work and play.

What does it mean to be a credit union member?

Even though there are over 250 credit unions in Canada, many misconceptions about their structure and their services still exist.

Why Is It Called A Credit Union?

While bank and banking are universally understood and accepted terms, the term credit union is still largely misunderstood and unknown to many.

It's A Money Thing Junior

Join the Synergy Academy!

What we do for our members and communities goes way beyond banking. We believe that helping you to prosper also means truly supporting you on your journey to becoming your own best financial advocate. This belief is a big part of our motivation to build It’s a Money Thing Academy, a set of free online money education courses that you can access at your convenience.

Search

Search

JOIN US

JOIN US